While travelling is a favourite pastime of many fellow Singaporeans, we see an increasing trend of Singaporeans taking the 'free-and easy', 'roads less-travelled' adventure travels overseas. With the vast amount of destination information available on travel destination guides like TripAdvisor and WikiTravel, it is not too hard to plan for a fun-filled, spontaneous, affordable holiday.

The downside, however, is the lack of a 'guardian angel' (i.e. travel guide) to take care of transportation, accommodation, medical, unexpected incident needs. Therefore, as a fellow traveller who have travelled a fair bit in recent years AND met a number of unexpected incidents on the trips, here's an article to share on some of our staff's recent travel insurance claims, and the process on how to make an insurance claim (for the various incidents).

Disclaimer: The intent of this post is to share on past instances of claims submitted for travel incidents, experienced by our own staff, to reiterate the importance of buying travel insurance. This article is not sponsored by any financial institutions nor insurance companies, and is not meant to promote/denounce any specific travel insurance plans. This article does not serve to compare any travel insurance plans too, since the premiums and coverage vary from time to time.

1. Flight delay

Place of incidence: Bangkok, Thailand

Incident and response: Our JetStar flight back to Singapore, was delayed for 7 hours due to inclement weather from its earlier route. We were informed by Jetstar both via email and SMS. No further response needed in Bangkok for the insurance claim, except spending a few more hours relaxing in the Land of Smiles.

Claim Category: Travel Delay

Company: ACE My VoyageGuard Travel Insurance (now known as Chubb)

Documents needed for the claim: Boarding Passes, Email/SMS from Airline

Claimed amount: ~$200

2. Flight brought forward

Place of incidence: Hue, Vietnam

Incident and response: Our VietJetAir flight departing from Hue towards Ho Chi Minh city was brought forward by 2 hours, and we were informed only via email the night before. As we didn't have internet connection then, we missed the brought-forward flight when we got to the airport and a subsequent connecting flight back to Singapore. As a result, without an available connecting flight after we arrived in Ho Chi Minh, we had to stay overnight in Ho Chi Minh city.

It was quite a nightmarish experience and we found it unbelievable that VietJetAir didn't provide SMS-notification service on flight changes for international customers. We chased the VietJetAir counter staff to provide a written explanation on the flight changes, but they were quite reluctant to do so. Persistence paid off in the end and we had a written explanation from them, which was essential for the claim.

Claim Category: Travel Postponement, Misconnection

Company: ACE My VoyageGuard Travel Insurance (now known as Chubb)

Documents needed for the claim: Flight itineraries, Boarding passes, New flight bookings, Hotel receipt, Explanation from airline

Claimed amount: ~$270 (Flight Delay + New Flight + Hotel)

3. Stolen possession

Place of incidence: Perth, Western Australia

Incident and response: Car was broken into while we went on sight-seeing, and our possessions were stolen when we returned to the car, having to spent the rest of the road trip without a side window. We took pictures of the damages and made a police report at the nearest police station. Note: Stolen items' value will be depreciated based on date of purchase, limited to $500 per item. Damages on rented vehicles to be claimed separately from rental car insurance.

Claim Category: Loss of Personal Property and Baggage

Company: ACE My VoyageGuard Travel Insurance (now known as Chubb)

Documents needed for the claim: Police report, Pictures, Flight Itineraries, Prices of items

Claimed amount: ~$250

4. Lost possession

Place of incidence: Seoul, South Korea

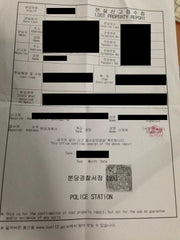

Incident and response: We were at a skiing resort, changing in and out of the skiing gear when we realised we lost our wallet containing money and an apartment card of a friend staying in Korea. We made a police report, but the Korean police didn't seemed too concerned and filed a report nonetheless. Note: Items borrowed/rented in foreign land are not covered by insurance and are not claimable.

Claim Category: Loss of Personal Property and Baggage

Company: DirectAsia Travel Insurance

Documents needed for the claim: Boarding passes, police report, Receipts of lost items*

*Note that this particular insurance firm imposes a maximum claimable value of $50 for lost items without purchase receipts (who keeps them?!)

Claimed amount: ~$150

5. Delayed baggage

Place of incidence: Changi Airport, Singapore

Incident and response: A checked-in parcel was missing when we returned to Singapore, so we lodged a report at the 'Lost & Found' office in the Arrival Terminal with our baggage receipts. The parcel was eventually found at our departure airport and was flown back to Singapore the following day. The parcel was delivered to our residential address on the same day. We were glad that the baggage was found within 24 hours (among the millions that each airport might have handled)

Claim Category: Baggage Delay

Company: ACE My VoyageGuard Travel Insurance (now known as Chubb)

Documents needed for the claim: Checked-in Luggage Labels (for reporting at the Lost & Found counter), Travel itinerary, Baggage return acknowledgement receipt

Claimed amount: ~$600 ($200 per 6-hour block)

6. Overseas Medical Expenses

Place of incidence: Dubai, United Arab Emirates

Incident and response: Bitten by an insect while on the roads, we sought medical treatment at a clinic in The Dubai Mall. Arabs and expats alike, are known to be well-paid and well-insured in UAE. As such, the medical expenses were expected to be high too.

What we didn't foresee, was the whopping $200 consultation fee for a GP doctor, and a $100 medication fee (for prescribed medicines that seem to be overprescribed). Without travel insurance's coverage, we would have burnt a hole in our pockets. Note: Great Eastern travel insurance provides coverage for less-travelled countries like Iran, Pakistan.

Claim Category: Overseas Medical Expenses

Company: Great Eastern TravelSmart Premier

Documents needed for the claim: Boarding passes, Flight itineraries, Medical receipts

Claimed amount: ~$300

7. Family bereavement

Place of incidence: Singapore

Incident and response: A relative passed on the day prior to a trip, so we had to cancel the trip entirely and forfeited the flight tickets. Cheaper flight tickets are generally non-refundable so we were fortunate to have bought travel insurance for the trip.

Claim Category: Travel Cancellation

Company: AIG Travel Guard

Documents needed for the claim: Flight itinerary, Obituary document

Claimed amount: ~$300 (Cost of flight tickets)

8. Damaged items

Even though we have not encountered this problem ourselves before, we have read from various sites on how their luggage have suffered horrific damages (due to the rough handling at airports), such as this:

Credits: KLM Singapore Facebook Page

While there might be rare/occasional damages sustained on checked-in luggage, our advice for the readers is to claim from airline companies upon receiving your damaged luggage or travel insurance companies.

Travelling on Singapore Airlines Business Class using a premium-branded Rimowa luggage doesn't necessarily mean incidents wouldn't happen either - read this TripAdvisor forum post.

9. Loss of Deposit due to Insolvency of Travel Agent

For travellers who prefer to travel via travel agencies, bear in mind the risk of Travel Agencies becoming insolvent, in these times of turbulent economic conditions.

"Five Stars Tours' closure in January last year affected at least 3,000 travellers, while at least 500 were affected when Asia-Euro Holidays shuttered in May." - Straits Times article

Therefore, it is just as important to consider this additional risk when purchasing your travel insurance.

Generally, based on past travel insurance claims, the insurance agencies responded within a week, and upon submission of all required documents, claimants will receive cheque/bank transfer within another week. Most of our trips were claimed from the same company as it becomes more economical to purchase Annual Travel Insurance plans (~$300) if you're travelling more than 4 times (rough guideline) a year.

While we've read articles on how important travel insurance is for all overseas trips, having experienced these unexpected incidents definitely convinced us that the risks are REAL! Happy risk-mitigated travels ahead!

P.S.: To get your luggage well-protected, we have a range of luggage covers available too! ;)

No comments:

Post a Comment